OFAC Compliance – what everyone needs to know!

While financial institutions are aware of Office of Foreign Assets Control (OFAC) compliance requirements and have mitigating controls in place, it is not unusual to see penalties for OFAC violations imposed on financial institutions. Moreover, since OFAC compliance has much wider applicability, everyone should have some basic awareness in the matter.

In recent times, not only some US and non-US banks, but non-banks, commercial organizations and even individuals have undergone closer scrutiny of their actions that violated OFAC regulations. For example, a large UK bank paid more than $657 MM to settle violations of multiple OFAC programs in 2019, company whose non-US affiliate serviced machines in Iran thus violating the Iranian sanction program of OFAC paid $13,381. In prior years, even individuals have paid amounts to OFAC for alleged violations of OFAC programs. This article aims at explaining the key aspects of OFAC Compliance that are of general interest to everyone due to its wide applicability.

Jurisdiction of OFAC

OFAC has a wider jurisdiction than the most of other regulations, including Anti-Money Laundering regulations. Compliance with OFAC controls, prohibitions and requirements is required of every individual in the United States regardless of citizenship, of branches and offices of foreign banks and foreign companies in the U.S. OFAC compliance is also mandatory for U.S. citizens whether they are in the U.S. or elsewhere. Similar responsibility is also applicable to all permanent resident aliens irrespective of location. U.S. incorporated companies, corporations, firms, etc., are also subject to OFAC compliance irrespective of location. Importantly, if there is an international trade or service related payment there is a predominant likelihood that the payment will be subject to OFAC regulations and any direct/indirect violations of those may result in penalties. Therefore, it is important to understand the mandate of OFAC.

OFAC’s Purpose and Authority

The Office of Foreign Assets Control (OFAC) is an arm of the U.S. Department of the Treasury created in December 1950 for administering and enforcing economic and trade sanctions against identified targets. These targets may be foreign countries, or individuals and organizations involved in terrorist activities, international narcotics trafficking, or in weapons of mass destruction proliferation. OFAC imposes controls on the transactions and assets of the targets and mandates blocking foreign assets that fall under U.S. jurisdiction even indirectly. Its objective is to identify and disrupt the activities of foreign adversaries and their support structures. For this purpose, it requires that access to the U.S. financial system be blocked and the ability to trade with U.S. companies denied to identified targets.

OFAC is not a bank/credit union/Financial Institutions (FI) regulator but works with regulators in ensuring compliance by FIs. OFAC has the authority to impose penalties for violations and has frequently done so.OFAC is probably the most vibrant organization and takes frequent actions to implement its mandate. Per OFAC’s website, it took seven actions during the first 14 days of 2020, or on average, one every alternate day!

OFAC Statutes/Programs

In accordance with its mandate, OFAC has various programs directed towards a country or purpose. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. The list of OFAC Sanction Programs, as of January 16, 2020 is as under:

Active OFAC Sanctions Programs

Balkans-Related Sanctions

Belarus Sanctions

Burundi Sanctions

Countering America’s Adversaries Through Sanctions Act of 2017

Central African Republic Sanctions

Counter Narcotics Trafficking Sanctions

Counter Terrorism Sanctions

Cuba Sanctions

Cyber-Related Sanctions

Democratic Republic of the Congo-Related Sanctions

Foreign Interference in a United States Election Sanctions

Global Magnitsky Sanctions

Iran Sanctions

Iraq-Related Sanctions

Lebanon-Related Sanctions

Libya Sanctions

Magnitsky Sanctions

Mali-Related Sanctions

Nicaragua-Related Sanctions

Non-Proliferation Sanctions

North Korea Sanctions

Rough Diamond Trade Controls

Somalia Sanctions

Sudan and Darfur Sanctions

South Sudan-Related Sanctions

Syria Sanctions

Transnational Criminal Organizations

Ukraine-/Russia-Related Sanctions

Venezuela-Related Sanctions

Yemen-Related Sanctions

Zimbabwe Sanctions

Each of the above programs has a different scope and target. For example, virtually all trade with the government of Iran, any Iranian entity, or any person in Iran is prohibited. However, when it comes to Cuba, certain remittances, travel and transactions with Cubans are permitted.

Specially Designated Nationals (SDN)

The OFAC term with which most of us are familiar is the Specially Designated Nationals or SDN. These are the ones that result in blocking assets. The SDN may be:

- Individuals and entities across the world

- Entities owned, controlled by or acting on behalf of targeted governments or groups

- Front companies, high-ranking officials or specifically identified persons

- Designated narcotics traffickers, terrorists, terrorist groups, WMD proliferators and support networks.

Blocking or Freezing of Assets

If the persons subject to OFAC jurisdiction come into possession of any asset or property that is subject to a program with blocking provision, the asset or property involved should be blocked.

Rejection of Transaction

Another action required for ensuring OFAC compliance is “rejection”. These relate to certain categories of transactions are forbidden. The primary purpose here is to prohibit any facilitation of trade transactions and prohibit any related access to the U.S. financial system.

Blocking versus Rejection

OFAC explains this very clearly with an example. In some cases, an underlying transaction may be prohibited, but there is no blockable interest in the transaction. In these cases, the transaction is simply rejected, or not processed. For example, a U.S. bank would have to reject a wire transfer between two third-country companies (non-SDNs) involving an export to a company in Sudan that is not subject to sanctions. Since there is no interest of the Government of Sudan or an SDN, there is no blockable interest in the funds. The U.S. bank cannot process the transaction because that would constitute a transaction in support of a commercial activity in Sudan, which is prohibited by the Sudanese Sanctions Regulations. Similarly, a U.S. bank could not be involved in the financing of a prohibited transaction. Please note that a U.S. bank cannot even advise a letter of credit if the underlying transaction is in violation of OFAC regulations.

The following examples may help illustrate which transactions should be blocked and which should be rejected.

- A U.S. bank interdicts a commercial payment destined for the account of a bank in Sudan. It turns out that this bank is wholly or majority-owned by the Government of Sudan and, accordingly, is a Specially Designated National of Sudan. This payment must, therefore, be blocked.

- A U.S. bank interdicts a commercial payment destined for an account of another bank located in Sudan. Unlike the bank in earlier example, this bank is a private sector entity so there is no blockable interest in this payment. However, processing the payment would mean facilitating trade with Sudan and providing a service in support of a commercial transaction in Sudan, therefore the U.S. bank must reject the payment.

Reporting of Blocked and Rejected Transactions

Once a transaction is blocked or rejected, it must be reported to OFAC within 10 days of the event. An annual report on blocked property held is also required.

Penalties for non-compliance

Failure to comply with OFAC requirements has far-reaching consequences. The prohibition on trading with a country or dealing in goods originating there becomes ineffective if these transactions are not readily identified and acted upon under terms of the OFAC requirements.

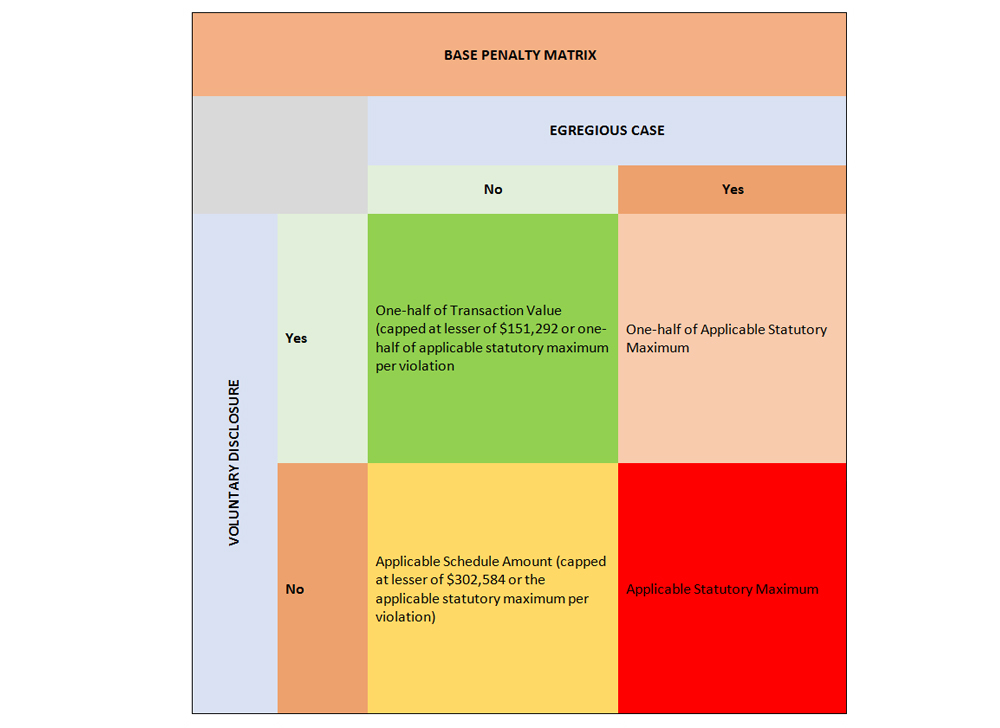

Violations of OFAC are therefore subject to penalties — civil and criminal. If any violation takes place despite the controls in place, it is in the best interest of everyone to inform OFAC voluntarily and promptly, as it may reduce the amount of penalty imposed by OFAC.

RGS Global Advisors is a leading provider of BSA/AML/OFAC Compliance and Internal Audit services to Community Banks and Foreign Banking Organizations. For further guidance or assistance contact us at: info@RGSGlobalAdvisors.com