I. LIBOR Sunset and SOFR Transition

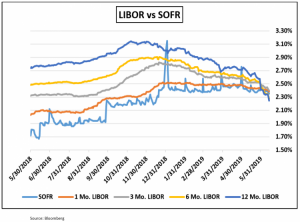

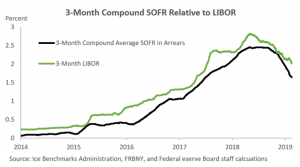

In 2014, the Federal Reserve asked the Alternative Reference Rates Committee (ARRC) to identify an alternative to London Interbank Offered Rate (LIBOR), the globally used reference rate. The alternative reference rate that was to be identified by ARRC was required to be robust, IOSCO-compliant, transaction-based rate derived from a deep and liquid market. The United Kingdom’s Financial Conduct Authority would no longer compel LIBOR panel banks to furnish data to support the determination of LIBOR after 2021. Based on the mandate from Federal Reserve and after evaluating a range of possible alternative rates, the ARRC selected the Secured Overnight Financing Rate (SOFR) in 2017 as the new reference rate.

There is still some degree of uncertainty surrounding the replacement of LIBOR as not all jurisdictions have decided on the plan for transition from LIBOR. This has caused some uncertainty in financial markets where progress is still being made in determining the risks, controls and processes regarding transitioning outstanding legacy transactions linked to LIBOR to SOFR or an alternate reference rate. Prudent risk management requires that every institution brainstorm, assess and understand the risks related to the cession of LIBOR and related transition.

However, SOFR is new, and industry is still deciding on its usage and related protocols. Most institutions are in early stages of deciding on definite plans for managing the transition and implementing SOFR, which would require operations, system and process changes. E.g.

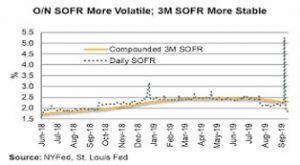

• SOFR is just one rate signifying the overnight borrowing rate, without the multiple tenors available with LIBOR.

• There are some challenges to be faced regarding the Futures. While LIBOR sets 2 days before the final trading day, SOFR is a daily average and the rate is published by FRBNY only on the following day, posing challenges regarding obtaining the final settlement rate on the day of the final settlement.

• SOFR index developed and used by an institution would require a daily feed.

• Changes to systems and processes may be required to account for SOFR linked interest accruals, which would be different from the LIBOR linked rates.

• Development of SOFR markets may require further modifications in the early periods after implementation.

The New York State Department of Financial Services (DFS), realizing the above status as also the fact that in the U.S. alone the gross notional value of all financial products linked to U.S. dollar LIBOR is approximately $200 trillion (about 10x U.S. GDP) reached out to regulated institutions on Dec 23, 2019 to seek assurance that regulated institutions’ boards of directors and senior management have assessed the risks associated with LIBOR cessation, developed an appropriate plan to manage them and have initiated actions to facilitate transition.

Response is due by March 23, 2020 and the DFS has clarified that no further extension would be provided. Institutions will, based on their products, services, markets and profile, have to consider these and other matters as they prepare their plans for the transition and for responding to the DFS that has asked for detailed plans and assurances that institutions, board of directors and senior management fully understand and have assessed the risks associated with LIBOR cessation, have developed an appropriate plan to manage them and have initiated actions to facilitate transition, and that they have:

• processes for analyzing and assessing alternative rates that would replace LIBOR linked rates in their institutions

• processes for analyzing and assessing potential associated benefits and risks of such rates both for the institution and its customers and counterparties

• programs or are developing programs to identify, measure, monitor and manage all financial and non-financial risks of transition

• established or are establishing processes for communications with customers and counterparties

• assessed or are assessing operational issues to develop a process and plan for operational readiness, including those related accounting, tax and reporting aspects of such transition, and

• established a governance framework, including oversight by the board of directors, or the equivalent governing authority, of the institution.

When submitting responses, the institutions may also keep in mind that FRBNY would publish daily three compounded averages of the SOFR with tenors of 30-, 90-, and 180-calendar days, beginning March 2nd, 2020. In addition to these three SOFR averages, the New York Fed is also proposing to publish daily a SOFR index that would allow the calculation of compounded average rates over custom time periods. This would prove to be very valuable data that the institutions can use in their new rates, and therefore it would be prudent to factor these into the proposed plans as the institutions move ahead.

II. BSA/AML continues to be a hot topic

a. Foreign Banks remain under scrutiny for their BSA/AML/OFAC compliance. Mashreqbank, psc – Consent Order and $40 MM penalty is a case in point.

• $30 Billion bank with $1.1 Billion assets in its New York Branch (branch)

• NYSDFS did an examination of branch in 2016 and a joint examination was done by FRBNY & NYSDFS in 2017

• Branch provides Correspondent Banking and Trade Finance services along with US Dollar Clearing

• Prior to 2016 examination, deficiencies were noted regarding Transaction Monitoring and Sanction Screening Filter’s Sensitivity Settings

• Due improvements were not noticed in 2016 examination and it was noted that the BSA/AML/OFAC policies lacked granularity; well-designed Transaction Monitoring System was still not fully implemented; proper use of due diligence information in files was not done in monitoring; sometimes 1st and 2nd level reviews were performed by same analyst; rational for disposition of alerts were broad and boiler-plate; there was a backlog of alerts; due diligence information was not robust enough

• 2017 examination noticed progress but continued deficiencies; Transaction Monitoring remained a challenge; Rules were not properly implemented; a single level review of alert was performed; rational for disposition of alerts were still broad; there was a 5-month backlog of alerts; despite new Sanction Screening tools, rationale for alerts were not appropriately documented and gaps in program implementation were there;

- weaknesses in Internal Audit were noticed; proper Independent Validation of prior Examination issues was not done and they relied on Management’s provided samples and information etc.

• NYSDFS imposed a Consent Order in October 2018 requiring major Corrective Actions and imposed Penalty of $40 Million.

b. Every institution, including small community banks, need to have robust BSA/AML/OFAC Program. Remember the Consent Order by FinCEN and $2 MM penalty against Loan Star Bank?

• Community bank located in Texas; About $2.2 Bn assets

• Willful Violation of BSA Program and BSA Reporting requirements during 2010 to 2014

• Failed to (a) establish and implement an adequate anti-money laundering (AML) program; (b) conduct required due diligence on a foreign correspondent account; and (c) review and report suspicious activity

• Number of high-risk accounts with missing customer due diligence information

• Lack of sufficient internal controls or experienced BSA staff

• Lack of appropriate due diligence and monitoring

• Failures allowed a single foreign financial institution to move hundreds of millions of U.S. dollars in suspicious bulk cash shipments through the U.S. financial system in less than two years

• Even after taking into account bank’s actions to correct deficiencies identified by OCC and independent parties; enhancement in Independent Testing, Training, AML Program and Customer Due Diligence (CDD), closure of the correspondent account, establishment of oversight Committees, independent Lookback and filing of SARs, providing additional resources, etc., FinCEN imposed a Civil Money Penalty of $2 Million (including $1 million imposed by OCC).

c. Beneficial Ownership and Customer Due Diligence Rules

Regulators are focusing on implementation of the rules (key points mentioned below) by Financial Institutions:

• Rules issued under the BSA to Clarify and Strengthen customer due diligence requirements

• Effective from May 11, 2018

• Impose explicit customer due diligence requirements, recordkeeping requirements

• Include new requirements to Identify and Verify the identity of beneficial owners of legal entity customers, subject to certain exclusions and exemptions.

• Under the definition, a legal entity will have a total of between one and five beneficial owners (i.e., one person under the control prong and zero to four persons under the ownership prong) on whom due diligence is to be performed and identity verified for every legal entity customer.

III. Cybersecurity

• While DFS rule Part 500 is in place for a while now, with the expiry of transition period the entire rule is in effect

• Federal Reserve Bank and the Office of Comptroller of Currency have ramped up its review, coverage and scrutiny of the cybersecurity controls at regulated entities.

• With increasing threats from rogue nations, other state actors and cyber criminals, the regulator focus on cybersecurity controls and oversight is only going to increase.

IV. Internal Audit

• Regulatory reliance on Internal Audit (IA) is all time high

• IA is expected to be very strong and comprehensive

• Expected to increase testing when validation and closing prior audit and regulatory examination comments

• Expected to review the work of consultants performing tasks for the function being audited

• Low tolerance amongst regulators for perceived shortcomings in IA

RGS Global Advisors is a leading provider of Risk Advisory, Internal Audit and Regulatory Compliance services to Banks and other Financial Institutions.

For further guidance or assistance contact us at: info@RGSGlobalAdvisors.com

References:

FRBNY Operating Policy; FRBNY ARRC; Bloomberg Article; SIFMA SOFR Primer; NYSDFS LIBOR Letter; NYSDFS LIBOR Date Update